India has emerged as one of the fastest-growing markets for digital payments. The widespread use of UPI payment apps in India has transformed the way people transact, from big cities to rural markets. If you are a foreigner visiting India, understanding how to use digital payments in India can make your trip easier and more secure.

In this comprehensive guide, we explain what UPI payment in India is, how you can access it as a visitor, and which are the best UPI payment apps in India that you can rely on.

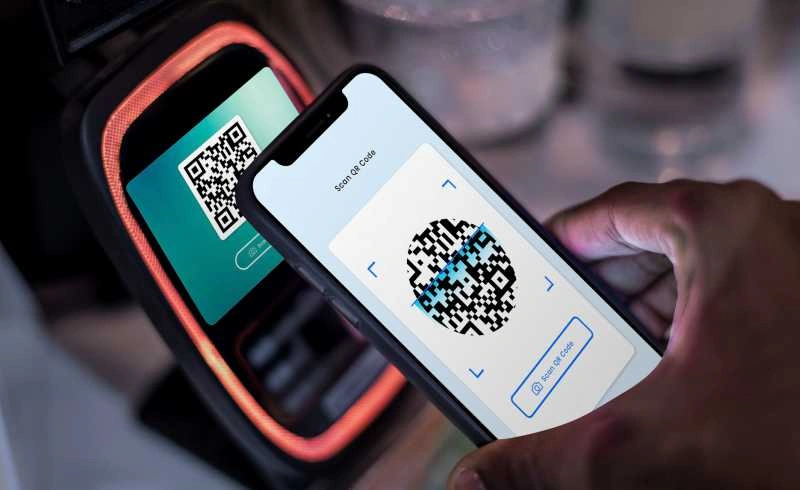

Unified Payments Interface, popularly known as UPI, is a real-time payment system developed by the National Payments Corporation of India. It enables direct money transfers between bank accounts via mobile apps. Unlike traditional banking methods, UPI payment in India allows transfers without sharing account numbers or IFSC codes. You can send or receive money using a simple UPI ID or by scanning a QR code.

Digital payments in India have become a part of daily life. Here are key reasons why you, as a foreign traveler, should consider using UPI payment apps in India:

Foreigners can use UPI payment apps in India, provided they meet some conditions. Traditionally, having an Indian bank account and a registered Indian mobile number were required. However, recent changes by the National Payments Corporation of India have made it easier for tourists under specific categories.

Most UPI payment apps in India require an Indian mobile number linked to your bank account for verification. Major telecom providers such as Jio, Airtel, and Vi offer tourist SIM cards with easy activation procedures.

If you hold an Overseas Citizen of India (OCI) status or plan an extended stay, opening a bank account in India can simplify your use of UPI services.

There are multiple UPI payment apps in India to choose from. The best UPI payment apps in India include:

Once you download your preferred app, follow the registration and KYC process. After your bank account is linked and your UPI PIN is set, you are ready to make payments.

Here is a look at some of the best digital payment apps in India that offer secure, reliable, and easy-to-use services:

Developed by the National Payments Corporation of India, this app is known for its simplicity and security. It supports all UPI-enabled banks and is ideal for basic transactions and bill payments.

Known for its smooth interface and rewards system, Google Pay is popular for both person-to-person and merchant payments. It supports multiple linked bank accounts and offers cashback deals.

Widely accepted across India, PhonePe supports bill payments, mobile recharges, shopping, and UPI payments. Its interface is available in multiple languages and offers easy transaction tracking.

Apart from UPI payments, Paytm offers wallet services, shopping options, ticket bookings, and bill payments. It is often used for quick transactions and mobile recharges.

Integrated with the Amazon shopping platform, Amazon Pay supports UPI payments and offers attractive cashback deals. It is ideal for frequent online shoppers.

A UPI payment gateway allows businesses to accept UPI payments from customers on their digital platforms. It connects the customer’s payment method with the merchant’s bank.

You will see UPI payment gateways integrated on websites and apps such as:

Some popular UPI payment gateways in India include Razorpay, PayU, and Cashfree.

Security is a top priority for UPI services in India. UPI uses advanced encryption and strict verification methods to protect users.

Important: Always download apps from trusted sources and never share your UPI PIN or OTP with anyone.

UPI payment in India is widely accepted in various sectors, including:

| Features | BHIM UPI Payment App | Google Pay | PhonePe | Paytm | Amazon Pay |

| Official NPCI App | Yes | No | No | No | No |

| Cashback Offers | No | Yes | Yes | Yes | Yes |

| Multi-language Support | Yes | Yes | Yes | Yes | Yes |

| Simple Interface | Yes | Yes | Yes | Yes | Yes |

| Linked Wallet Option | No | No | No | Yes | Yes |

Recommendation: If you are looking for an official, straightforward app for UPI payments, the BHIM UPI Payment App is a reliable choice. For added features like rewards, Google Pay or PhonePe are also excellent options.

India’s transition to a digital economy has been swift, and the use of digital payments in India is now part of everyday life. UPI payment apps in India make it easier for travelers and tourists to navigate financial transactions without the need for cash.

With simple setup processes, user-friendly apps, and strong security measures, UPI payments offer a convenient option for foreigners visiting India. Choose the best digital payment app in India that fits your needs, follow basic safety practices, and enjoy a seamless, cashless experience throughout your trip.

You are one step closer to having the best journey of your lifetime! Talk to us, write to us all that you have envisioned for your India trip, and one of our travel experts will connect with you on priority. To help you explicitly we have WhatsApp and Email addresses!